Because the IRA might be solely in your title, you may make contributions to it, simply as you’ll if the IRA had at all times been in your name. Most gold IRA companies either advocate or require that you work with a selected custodian and depository, though some offer you a alternative of two or more. The 2 most typical sorts of IRAs are conventional IRAs and Roth IRAs. Some quite common types of IRA-permitted gold are American Eagle proof coins and bullion, and Canadian Maple Leaf coins. The guide also arms you with methods for buying physical gold IRA belongings, exploring the pros and cons of buying bullion coins, bars, and rounds, and helping you choose one of the best possibility primarily based in your needs and objectives. Treasured metals that fall outdoors these parameters are considered collectibles and are usually not eligible for preferential tax therapy. The benefit in letting them handle your switch is that the money is never in your hands, legally speaking, Best Gold Ira Accounts which removes the prospect of having to pay an early withdrawal penalty in addition to income taxes (you’ll nonetheless pay taxes, after all, however only when you are taking distributions). In December 2019, the Setting Every Group Up for Retirement Enhancement (Safe) Act bought rid of the utmost age for making contributions; previously, it was 70 1/2 years outdated.

Because the IRA might be solely in your title, you may make contributions to it, simply as you’ll if the IRA had at all times been in your name. Most gold IRA companies either advocate or require that you work with a selected custodian and depository, though some offer you a alternative of two or more. The 2 most typical sorts of IRAs are conventional IRAs and Roth IRAs. Some quite common types of IRA-permitted gold are American Eagle proof coins and bullion, and Canadian Maple Leaf coins. The guide also arms you with methods for buying physical gold IRA belongings, exploring the pros and cons of buying bullion coins, bars, and rounds, and helping you choose one of the best possibility primarily based in your needs and objectives. Treasured metals that fall outdoors these parameters are considered collectibles and are usually not eligible for preferential tax therapy. The benefit in letting them handle your switch is that the money is never in your hands, legally speaking, Best Gold Ira Accounts which removes the prospect of having to pay an early withdrawal penalty in addition to income taxes (you’ll nonetheless pay taxes, after all, however only when you are taking distributions). In December 2019, the Setting Every Group Up for Retirement Enhancement (Safe) Act bought rid of the utmost age for making contributions; previously, it was 70 1/2 years outdated.

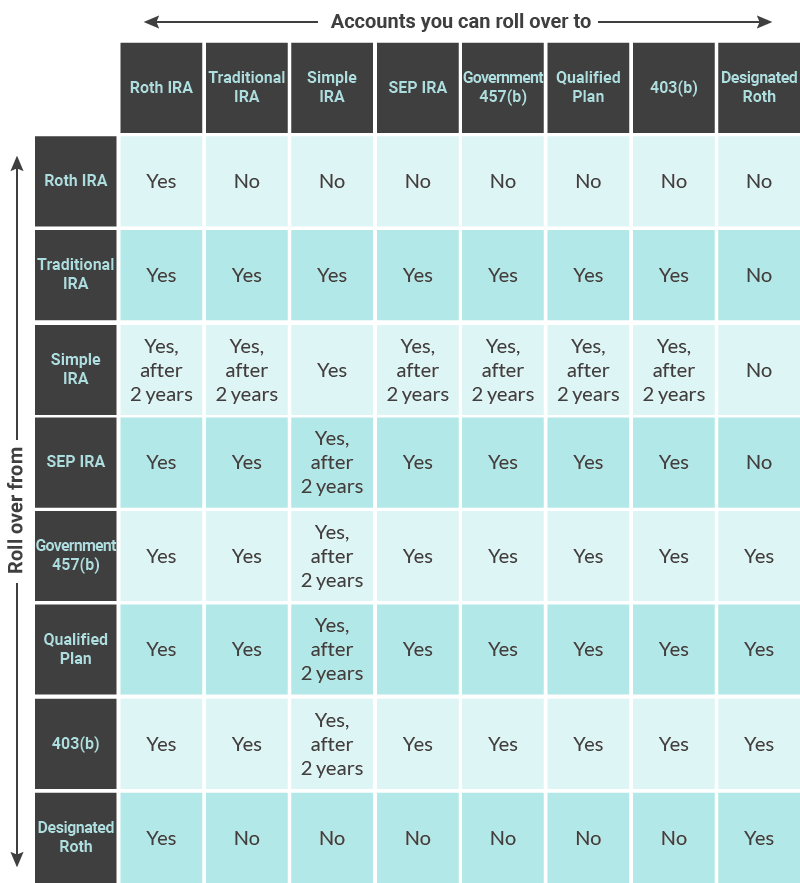

In conclusion, maximizing your workout efficiency at Gold Gym requires setting clear goals, planning workouts in advance, utilizing tools successfully, incorporating HIIT strategies, monitoring progress, and making needed adjustments alongside the best way. Certainly one of the key factors in maximizing your workout effectivity at Gold Gym is setting clear goals and planning your workouts accordingly. When organising and contributing to a Roth IRA, it’s important to understand the foundations for what can be used as contributions. Gold IRAs fall under IRA guidelines for self-directed IRAs, which allow for tax-most well-liked treatment of other property, however the foundations governing contributions are the identical as for a traditional IRA: In 2022, you may contribute up to $6,000 in case you are underneath the age of 50, and up to $7,000 if you’re older. A common option to fund a brand new gold IRA account is to use funds that are already held in another retirement account, resembling another IRA, 401(ok), 403(b), 457(b) or Thrift Savings Plan, in accordance with IRS rules. With this account, you may deduct the taxes when you’re making contributions, however your payments might be taxed when you start collecting funds. In case you have a gold IRA, you’ll incur prices to handle the account, in addition to upkeep fees, and prices for safe storage and insuring your gold. Many newspapers may have an obituary section that comprises information on these who’ve lately handed away in the world.

• When it’s a must to take RMDs, you may choose to liquidate the gold or have the metallic shipped to you – make sure you perceive the costs of every, and factor these into your budget. You’ll hold the physical coins or gold bullion bars themselves, and you’ll elect to have the metallic shipped to you when you are taking distributions. The forms of securities held in the fund determine how distributions are taxed. Not all money is created – or taxed – equally. As an example, certified dividends are taxed as long-time period capital positive factors, however nonqualified dividends are taxed at normal revenue charges. For example, belongings held for multiple year will probably be subject to capital positive aspects tax. To avoid the penalty, you could remove the contribution, plus any features on the money, earlier than your tax filing deadline. Roth IRA Short-Time period Beneficial properties Vs. Nevertheless, it is best to use Kind 8606 to report quantities that you simply converted from a standard IRA, a SEP, or Simple IRA to a Roth IRA. For individuals with substantial amounts of expensive debt – corresponding to massive balances on high-curiosity credit score cards – that pile of IRA cash would possibly appear like a horny option to quickly pay off debt.

Educational materials provided by IRA companies may shed mild on how gold might form a part of a various portfolio to mitigate any related risks from other assets like stocks and bonds. Unlike other materials used in jewellery making corresponding to platinum or silver which may lose value over time as a result of adjustments in market demand or availability, the value of gold stays constant. Moreover, adjustments in shopper demand for jewelry and industrial applications can influence general demand for gold. If you are thinking of beginning a Simple IRA, it is advisable to be aware that some recent adjustments. Can I Contribute to a 401(okay) & a Easy IRA in the same Yr? As an worker with a Simple IRA, best gold IRA accounts you possibly can contribute as much as $13,500 in 2021 (up to $14,000 for 2022), plus an extra $3,000 if you’re no less than 50 years outdated. In case you lose your job and gather state or federal unemployment compensation for at least 12 consecutive weeks, you need to use IRA money to cover your medical insurance coverage premiums penalty-free. Even when you may scrape collectively 20 p. If you have any thoughts relating to in which and how to use best Gold Ira accounts, you can make contact with us at our webpage. c to cover the down payment, there are closing prices, mortgage insurance and other charges that may add hundreds to your invoice.

Even if you qualify for money assistance beneath Medicaid’s Supplemental Security Revenue (SSI) program, it still won’t be sufficient to cowl your expenses. Some folks merely do not know tips on how to articulate what they really feel or think, but others can’t even be sincere with themselves sufficient to grasp those thoughts and feelings. The contribution limits to IRAs still apply even when you’re eager to invest in an IRA CD, so it may very well be some time before you may have sufficient money stashed in your IRA. Upon getting set your objectives, it’s essential to plan your workouts prematurely. To avoid a 6 % penalty, you should withdraw the $5,000 plus any earnings earlier than your tax filing deadline. Your valuable metals should be held by an IRS-accredited depository. Silver should be 99.9% pure. You will be required to begin cashing in some of those silver coins — and that is when Uncle Sam will want his share of the proceeds.