by ahzterrell | Wed, Aug , 2024 | Blogging

Can an IRA invest in treasured metals? This one applies to 401k rollovers and IRA transfers and is nice for 1%. That 1% may actually add up if the 401k stability is large. Transfers out of the retirement account in lower than 5 years might lead to a recapture of the...

by susannaearsman6 | Fri, Jul , 2024 | Blogging

The national government mint is a standard entity that will produce certified gold bullion. After making the purchase, your custodian will place your IRA-permitted gold into a depository that was pre-permitted by the IRS. If you don’t have the funds to pay taxes...

by melvinal30 | Wed, Jul , 2024 | Blogging

You’re allowed to take a withdrawal out of your IRA account to make a primary-time house buy. The tax benefits of a Gold IRA are additionally attractive, as funds going into the account are pretax contributions, delaying the payment of taxes till the time of...

by akio02 | Wed, Jul , 2024 | Blogging

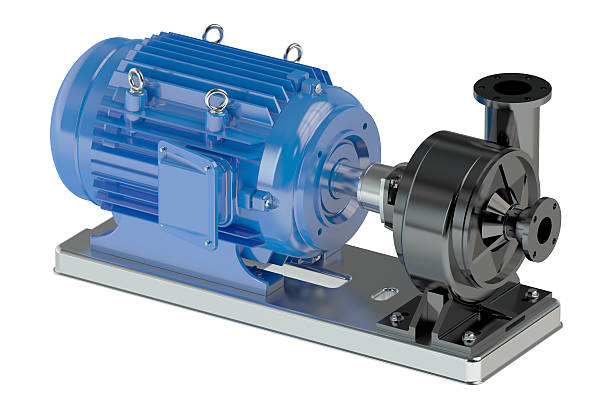

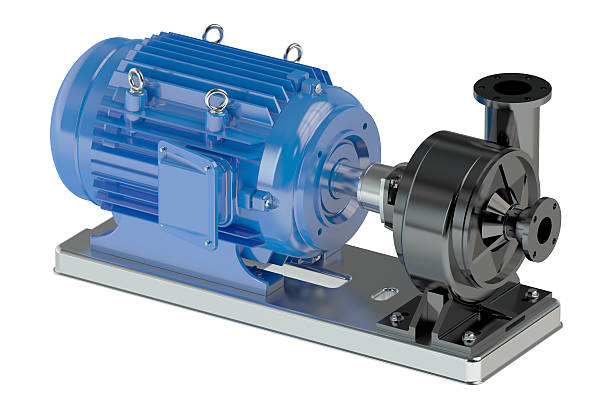

Vacuum Pumps Key market insights include: Market Size and Growth: The Global Vacuum Pumps Market size is expected to rise at a CAGR of around 7.46% during the forecast period 2020-2025. Regional Analysis: North America, South America, Europe, Middle East & Africa,...