But the phrase “gold IRA” is extra generally used as a form of shorthand to confer with this sort of self-directed IRA. Most gold IRA companies either advocate or require that you’re employed with a specific custodian and depository, although some give you a selection of two or more. The 2 most common types of IRAs are conventional IRAs and Roth IRAs. A traditional gold IRA is the most typical sort of gold IRA (and the sort discussed throughout this guide except in any other case specified). If you enjoyed this information and you would certainly like to get more information relating to Www.xaphyr.Com kindly go to our web site. The guide also arms you with methods for buying physical gold IRA assets, exploring the professionals and cons of shopping for bullion coins, bars, and rounds, and serving to you choose one of the best option based on your needs and goals. A gold IRA lets you hold bodily valuable metals while receiving the same tax benefits as conventional IRA investments in paper assets corresponding to stocks, bonds and mutual funds. Based on IRS rule 72(t) – that’s the rule that establishes the 10 percent early withdrawal penalty – you can avoid the ten percent hit if you happen to withdraw a portion of your cash out of your IRA in a collection of fastidiously calculated annual payments. In December 2019, the Setting Each Neighborhood Up for Retirement Enhancement (Safe) Act bought rid of the utmost age for making contributions; beforehand, it was 70 1/2 years outdated.

But the phrase “gold IRA” is extra generally used as a form of shorthand to confer with this sort of self-directed IRA. Most gold IRA companies either advocate or require that you’re employed with a specific custodian and depository, although some give you a selection of two or more. The 2 most common types of IRAs are conventional IRAs and Roth IRAs. A traditional gold IRA is the most typical sort of gold IRA (and the sort discussed throughout this guide except in any other case specified). If you enjoyed this information and you would certainly like to get more information relating to Www.xaphyr.Com kindly go to our web site. The guide also arms you with methods for buying physical gold IRA assets, exploring the professionals and cons of shopping for bullion coins, bars, and rounds, and serving to you choose one of the best option based on your needs and goals. A gold IRA lets you hold bodily valuable metals while receiving the same tax benefits as conventional IRA investments in paper assets corresponding to stocks, bonds and mutual funds. Based on IRS rule 72(t) – that’s the rule that establishes the 10 percent early withdrawal penalty – you can avoid the ten percent hit if you happen to withdraw a portion of your cash out of your IRA in a collection of fastidiously calculated annual payments. In December 2019, the Setting Each Neighborhood Up for Retirement Enhancement (Safe) Act bought rid of the utmost age for making contributions; beforehand, it was 70 1/2 years outdated.

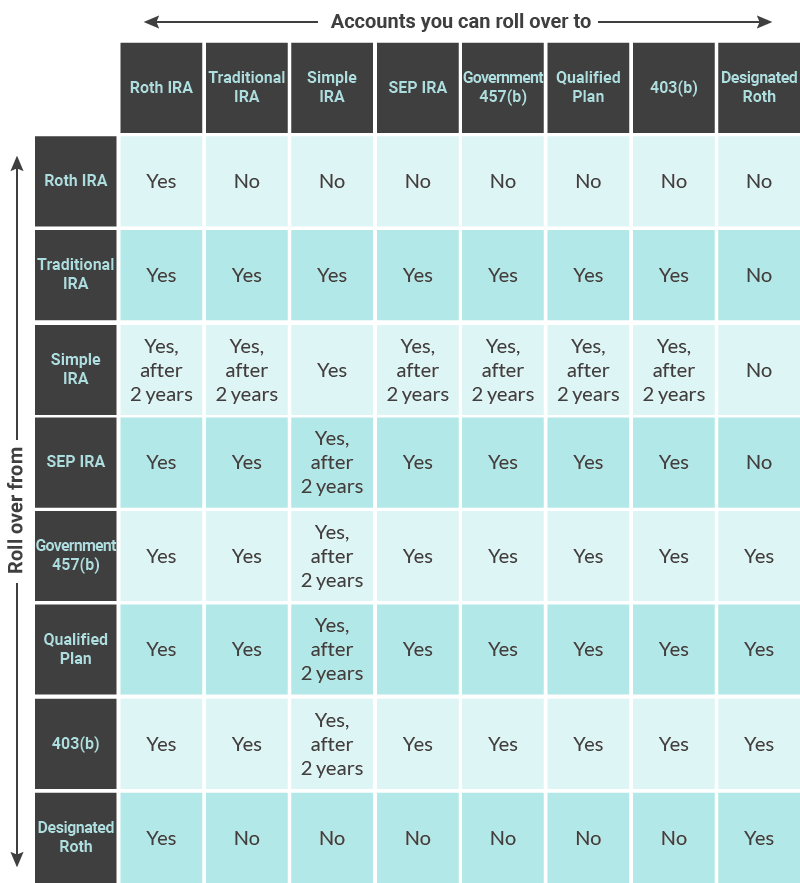

In conclusion, maximizing your workout efficiency at Gold Gym requires setting clear targets, planning workouts upfront, using equipment successfully, incorporating HIIT strategies, monitoring progress, and making mandatory adjustments alongside the way. One in all the important thing elements in maximizing your workout efficiency at Gold Gym is setting clear objectives and planning your workouts accordingly. When organising and contributing to a Roth IRA, it will be significant to understand the principles for what can be used as contributions. Gold IRAs fall under IRA guidelines for self-directed IRAs, which permit for tax-most well-liked treatment of alternative assets, however the foundations governing contributions are the same as for a standard IRA: In 2022, you possibly can contribute up to $6,000 in case you are underneath the age of 50, and as much as $7,000 if you are older. A typical method to fund a new gold IRA account is to use funds which might be already held in one other retirement account, reminiscent of one other IRA, 401(okay), 403(b), 457(b) or Thrift Savings Plan, in accordance with IRS guidelines. The value of these metals can grow tax-free whereas within the account, but you won’t benefit from the steadiness-constructing power of dividends. If in case you have a gold IRA, you’ll incur prices to manage the account, as well as upkeep charges, and prices for secure storage and insuring your gold. In case you solely have unearned earnings for the year, you cannot open an IRA or make contributions, because the IRS units your contribution limit on the lower of your compensation or the annual contribution.

Additionally, you’ll should take annual distributions based on either the decedent’s life expectancy or your individual, as determined by IRS tables. You’ll hold the bodily coins or gold bullion bars themselves, and you may elect to have the steel shipped to you when you are taking distributions. The kinds of securities held within the fund determine how distributions are taxed. It has to with when you’re taxed.With a traditional IRA, your contributions to the account are usually not taxed. As an example, qualified dividends are taxed as lengthy-time period capital good points, but nonqualified dividends are taxed at regular earnings charges. For instance, property held for multiple yr will be topic to capital positive aspects tax. To avoid the penalty, you will need to remove the contribution, plus any positive aspects on the money, earlier than your tax filing deadline. Roth IRA Quick-Term Positive factors Vs. For 2021 and 2022, the utmost you’ll be able to contribute is $6,000 ($7,000 if not less than 50) to all conventional and Best Gold IRA Accounts Roth IRAs combined. For people with substantial amounts of expensive debt – such as giant balances on excessive-interest credit score cards – that pile of IRA money might appear like a pretty technique to quickly repay debt.

Whereas traditional IRAs, 401(okay)s and the like are set as much as make it simple for you to build a various retirement portfolio as a way to mitigate danger, a precious metals IRA is devoted to a single asset class. Not like different supplies used in jewellery making resembling platinum or silver which can lose worth over time as a result of adjustments in market demand or availability, the value of gold stays constant. Furthermore, modifications in consumer demand for jewellery and industrial applications can influence total demand for gold. If you’re thinking of beginning a Simple IRA, it is advisable to remember that some recent modifications. Can I Contribute to a 401(okay) & a Easy IRA in the same 12 months? As an worker with a Simple IRA, you can contribute as much as $13,500 in 2021 (as much as $14,000 for 2022), plus a further $3,000 if you are at the least 50 years old. If you happen to lose your job and collect state or federal unemployment compensation for at least 12 consecutive weeks, you need to use IRA money to cowl your medical insurance coverage premiums penalty-free. Even if you may scrape collectively 20 % to cover the down cost, there are closing costs, mortgage insurance coverage and different fees that may add hundreds to your invoice.

Even for those who qualify for cash help beneath Medicaid’s Supplemental Safety Income (SSI) program, it nonetheless may not be sufficient to cowl your expenses. Some people simply have no idea find out how to articulate what they feel or assume, but others can’t even be trustworthy with themselves enough to understand these ideas and feelings. The contribution limits to IRAs still apply even when you’re wanting to invest in an IRA CD, so it might be a while earlier than you have sufficient cash stashed in your IRA. You would have to make one heck of a superb funding to recoup those losses. To avoid a 6 percent penalty, you will need to withdraw the $5,000 plus any earnings before your tax filing deadline. Silver must be 99.9% pure, and platinum and palladium must every be 99.95% pure. Silver have to be 99.9% pure. You’ll be required to start out cashing in some of those silver coins — and that’s when Uncle Sam will need his share of the proceeds.